Analysis: What to Expect in the 2018 Freight Market

12/19/2017

As 2017 closes and another New Year approaches, our team has worked to compile a list of things shippers should be planning for in 2018.

Looking back at 2017, the freight market continued to recover and pick up speed from the 2015 freight recession. The improving economy and on-going driver shortage combined with natural disasters and regulatory changes were some of the largest driving forces for the market changes. Ocean carrier consolidation continued and attention turned to the hot topic of free trade as well as the trade imbalance. As far as big-box retail logistics, the world’s powerhouse brands continued to place more emphasis on delivery compliance by shortening must-arrive by dates and holding suppliers accountable financially.

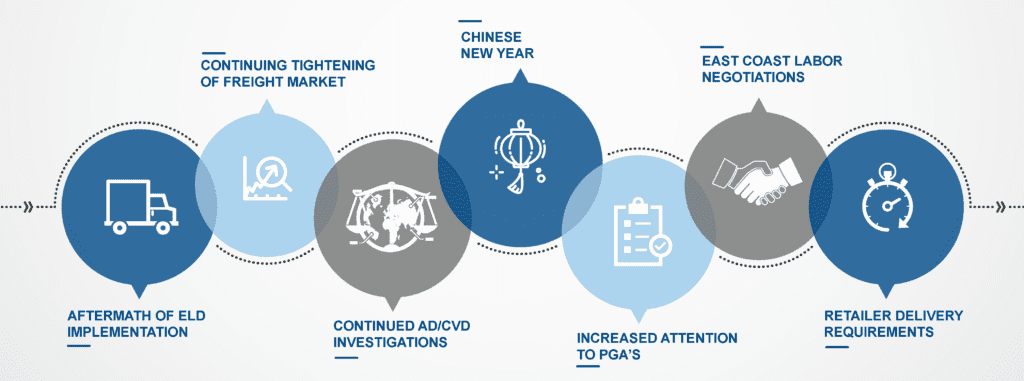

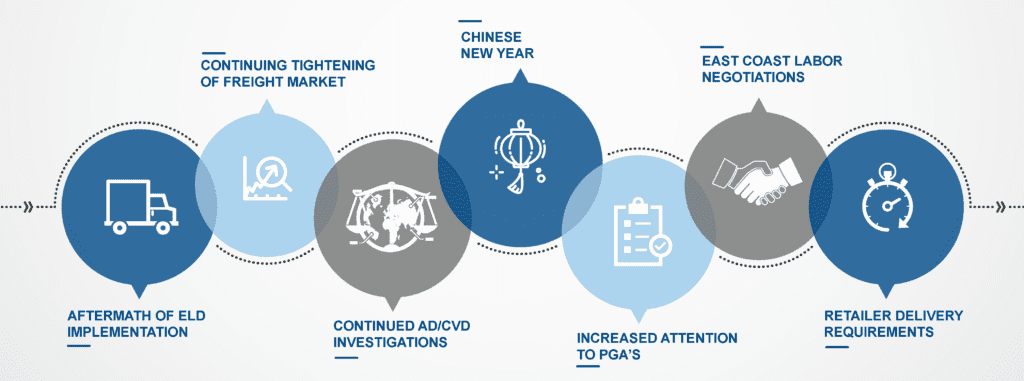

So what are some of the events shippers should expect to encounter in the world of logistics in 2018?

DOMESTIC

Aftermath of ELD Implementation

The ELD (Electronic Logging Device) mandate gained considerable coverage in 2017 and while it has already officially taken effect, enforcement will be gradually phased in. However, as of April 2018, truck drivers could be put out of service if found to be noncompliant. Some industry analysts estimate that the new mandate will prompt smaller companies and/or independent contractors to exit the industry which would further limit available capacity space. The ELD mandate is also expected to cause spot market rates to increase.

Continuing Tightening of Freight Market

Combining the ELD mandate with a driver shortage and overall increasing freight volumes, the freight market is projected to continue tightening in 2018. This means that shippers should expect to pay more for the same loads. One proactive step shippers can take is to utilize technology that provides access and transparency into market competitive rates, tools to manage carrier score carding and the power to provide in-depth reporting. Robust technology can help transportation and logistics leaders quickly compile intel to be able to clearly communicate why transportation costs are up year-over-year.

Automation & Electric Trucks

In 2017, Tesla unveiled its electric truck with many of the largest retailers and asset-backed carriers announcing pre-orders. Our team expects that technology and automation will continue to make headlines in 2018 but widespread adoption will remain dependent on legislature. While we don’t expect the industry to undergo massive changes in 2018, news buzz around the topic will continue and the possibility of driverless trucks should certainly be considered for three to five year supply chain plans.

INTERNATIONAL

Chinese New Year

For newer importers, it is extremely critical to plan for the annual Chinese New Year (CNY) holiday, which will occur from February 16-21 this year. The CNY essentially shuts down all Chinese and many other Asian supply chains for at least one week. This means that all communication, production and shipping will be halted for at least seven days. Origin workers could take up to a month of vacation which will drastically impact supply chain operations the weeks before and after the official holiday dates. Importers should communicate early with overseas vendors to ensure enough stock is in motion prior to February to avoid out of stock issues.

Increased Attention to PGA’s

Partner Government Agencies (PGA’s), such as FDA, FWL, Lacey, TSCA, EPA and CPSC, are flagging an increased number of products for safety and environmental reasons. For example, FWL has increased the number of tariffs it monitors from only 300 to almost 3,000. For importers, this could impact the number of products they must supply documentation for and it also increases the time it takes U.S. Licensed Customs Brokers to work with the client to identify if the product should be flagged under a certain PGA. If importers fail to claim PGA’s on items that should be flagged, legal and financial penalties could be assessed.

AD/CVD Investigations

As in 2017, the number of AD/CVD investigations are expected to continue to increase and importers should actively monitor the Federal Register and the international Trade Administration for product and country specific information. If AD/CVD investigations conclude that imported products are harming U.S. industries or producers, costs for importers could drastically increase due to additional duties and taxes.

NAFTA Renegotiations

Throughout this year, five rounds of NAFTA (North American Free Trade Agreement) negotiations have occurred between the U.S., Canada and Mexico. The negotiations are likely to proceed through at least the first half of 2018. If the free trade agreement takes on substantial changes the freight market alongside key industries including Automotive, Textile and Agriculture, stand to be majorly impacted. Numerous shipping aspects including average price and transit times could change if NAFTA is re-written.

East Coast Labor Negotiations

The current East Coast Labor contract is set to expire on September 30, 2018 and port operations have a higher likelihood of being impacted as the date approaches. The international shipping industry witnessed massive disruptions in the most recent West Coast labor negotiations and while the ILA (International Longshoremen’s Association) and USMX (United States Maritime Alliance) have stated they are committed to reaching a deal before the expiration date, the topic of automation continues to be the most difficult for the parties to agree upon.

RETAIL

Importance of Delivery Compliance

During 2017, Walmart introduced its new OTIF (On Time & In Full) initiative which drastically changed the delivery requirements for suppliers. If Walmart suppliers do not deliver the correct volume within the established delivery window, charge backs will occur. Many suppliers have discovered the benefits of Retail Consolidation as traditional LTL (Less-than Truckload) networks have struggled to provide the delivery preciseness needed to comply with the new delivery requirements. Walmart is not the only big-box retailer to begin pressuring suppliers as companies emphasize lean supply chains to support e-commerce and changing consumer expectations.

Mobile & E-Commerce Strategies

With increased amounts of retail sales occurring online and through mobile devices, the supply chain will only continue to evolve in the next 12 months. Consumers have come to expect free, next day shipping and this will continue to pressure the supply chain to remove inefficiencies. This is also expected to impact where goods are physically stored. In order to execute delivery within 24 hours after purchase, a network with one single point of inventory storage cannot economically reach many destinations on time. Therefore, inventory must be stored closer to consumers, driving demand for warehouse space and consequently impacting the cost for warehousing.

With a constantly evolving transportation market, how can shippers prepare for success?

The secret to success is the development of plan A and then detailed contingency plans. Finding a strong logistics partner, powered by technology, can also help companies make intelligent supply chain adjustments throughout the year.

If you need help planning for success in 2018, contact our logistics experts to learn more about our comprehensive suite of solutions and state-of-the-art logistics technology.